Payroll Software

COACH PAYROLL SOLUTIONS

Simplify payroll management with COACH Payroll—an automated, secure, and efficient system that minimizes errors, saves time, and enhances HR operations. Designed for businesses of all sizes, it ensures seamless and legally compliant payroll processing.

Manage your employee data much easier!

Smart Payroll Software for Efficient Salary Management

Smart, secure, and compliant. Automate payroll with ease, save time, and ensure accuracy for any business size.

Sample Key Features of PAYROLL AUTOMATION

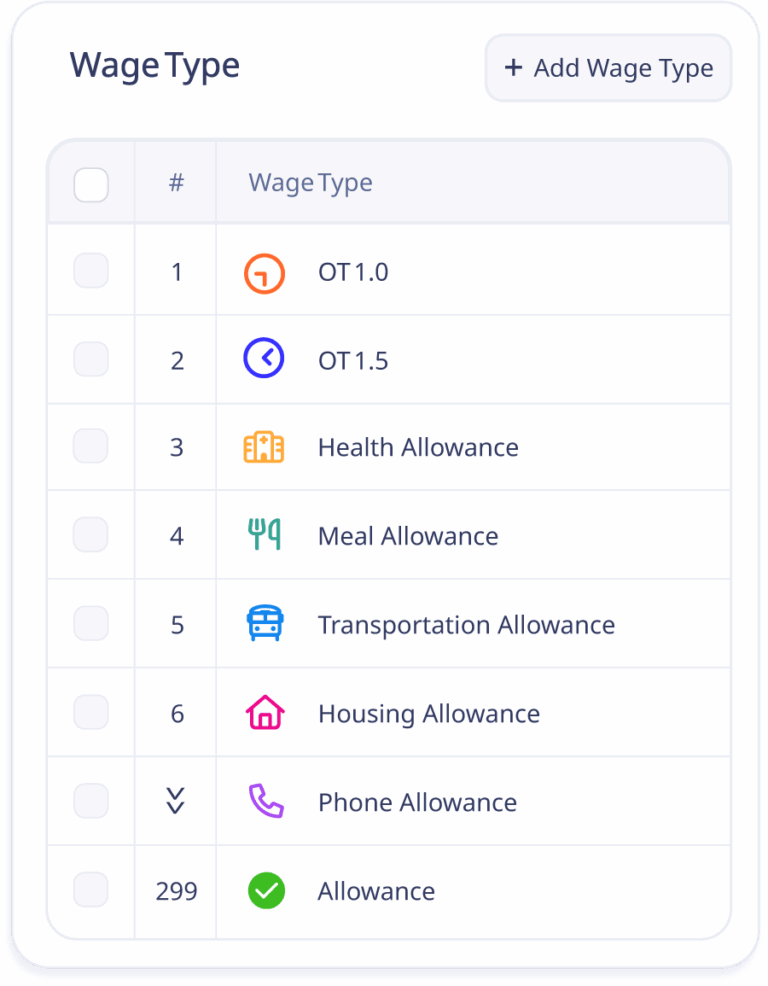

Unlimited Wage Type

Calculate overtime, bonuses, incentives, and special payments in real time—no matter how complex.

Easily manage unlimited earning and deduction types, all within one powerful system. Accurately generates Kor Thor 20 tax forms with 100% compliance to Thai labor laws.

Automated salary transfers to all banks — Just one click

Secure, direct salary transfers to employee bank accounts—fast, reliable, and fully supported by all major banks in Thailand. Seamlessly deliver payment data in ISO 20022 international standard via COACH Auto Flow

A customer experience that goes beyond expectations

Scale your business with no limit

Manage multiple companies effortlessly in a single payroll software—no limits on company count. Customize workflows to match your organizational and payroll structures, and process payroll quickly without switching logins between companies.

Unlimited fund participation to strengthen long-term tenure

Supports provident funds, employee welfare funds, and internal company funds—empowering long-term financial security. Boost employee confidence and motivation with our COACH payroll software.

Security and Governance

Protect your employee data with confidence through globally recognized security standards ISO27001, ISO27701 and ISO29110. Our platform ensures robust Information Security, Privacy Management, and Secure Software Development. With advanced encryption and Single Sign-On (SSO) support, your data stays safe, private, and fully compliant at every level.

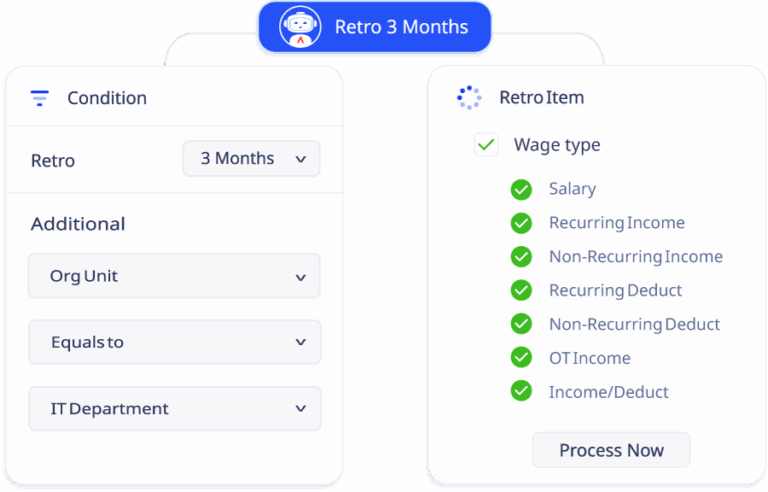

Automate retro pay and retroactive deductions

Say goodbye to manual back pay and retroactive deductions—no more calculations outside the system.

Our automated payroll software tools handle adjustments with precision, reduce errors, and help HR work faster, more accurately, and professionally.

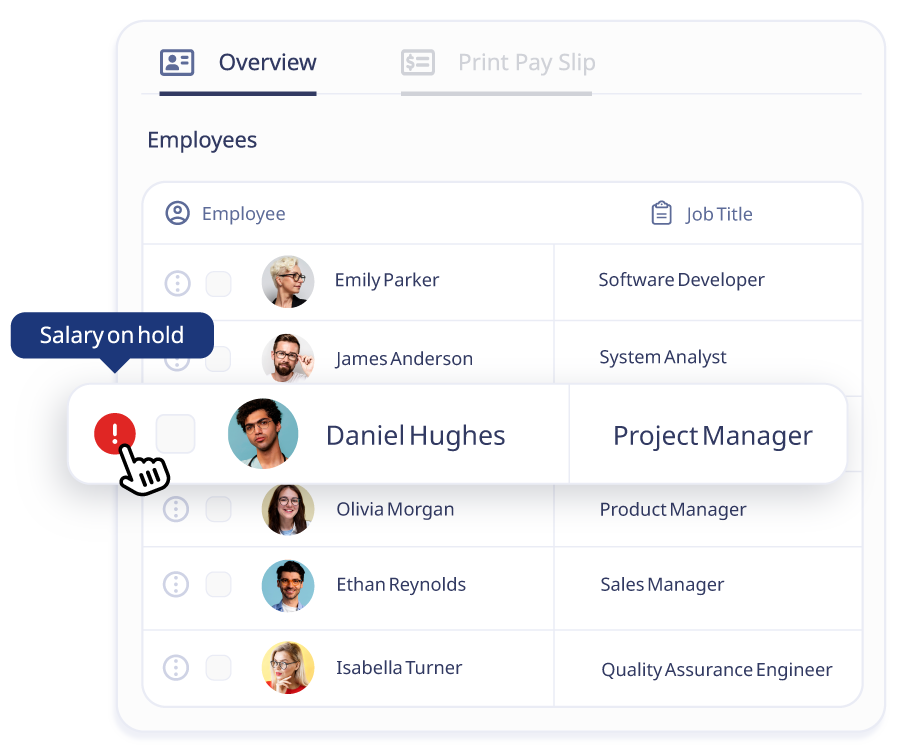

Holding employee salaries is made simple

Holding employee salaries is simple and systematic with flexible, transparent tools that allow HR to control, manage, and track salary holds efficiently—all in one complete system. Common use cases include unreturned company asset deposits or outstanding debts from certain employee benefits. In cases of serious misconduct, the organization may hold the employee’s salary during the disciplinary investigation process.

Trusted by leading organizations

Why Choose COACH Payroll?

Reduce Time and Cost

Streamline processes and save on HR resources

COACH Payroll simplifies payroll calculations, speeds up reporting, and automates tax deductions. Eliminate time-consuming tasks and reduce hidden costs caused by manual errors.

Compliant with Thai Labor Laws

Strongly stay compliant with local regulations

Designed for Thai labor laws, local HR software ensures accurate tax, social security, and provident fund calculations. With frequent legal updates in the Royal Thai Government Gazette, compliance is key. Global HR solutions like often lack Thai-specific tax logic—making them less suitable for local use.

Minimize Errors

Reliable and accurate system with automatic backdated calculations

The system supports retroactive calculations for up to 12 periods, minimizing issues related to back pay or deductions. HR no longer needs to handle these manually, ensuring fewer errors and greater credibility.

Why Modern Organizations Should Use Payroll Software Instead of Traditional Methods

Enhances organizational credibility with a standardized payroll system.

A reliable payroll system builds trust through compliance with labor laws and consistent salary calculations.Reduces the workload and resource demands on HR teams.

Automating payroll tasks allows HR personnel to focus on more strategic functions.Increases data accuracy and ensures secure employee record management.

Payroll systems minimize human errors and securely store employee data with high system stability.Simplifies complex processes through flexible payroll functionality.

All payroll-related operations—including tax calculations, income and deductions—can be managed through a single system.Optimizes workforce allocation by reducing manual tasks.

Automating payroll frees up staff for higher-value tasks and enhances overall efficiency.Reduces legal complexity by keeping up with Thai labor and tax laws.

A payroll system helps organizations remain compliant without needing manual legal tracking.

Why Integration with Other HR Systems Matters

Enables real-time data accuracy through centralized databases.

Payroll systems that connect with HRM and HRD modules ensure job, salary, and employee data are always up to date.Automates salary adjustments based on performance or budget approvals.

When linked with Performance Appraisal or Compensation Budgeting modules, the system can automatically update payroll calculations.Minimizes errors from manual data entry or duplication.

Integrated systems reduce the need for importing/exporting data across platforms

Benefits of Using a Unified Platform Like COACH HCM

Eliminates redundant processes by centralizing data.

No need for duplicate tasks between HR, payroll, and development modules.Improves overall data accuracy across the organization.

A single source of truth ensures consistency in reports and decision-making.Makes data analysis easier and more powerful.

Easily compare employee salary data with performance metrics to inform HR strategy.