Starting in 2026, the Social Security Office (SSO) will implement a major adjustment to the wage ceiling and contribution ceiling used for calculating monthly contributions under Section 33. This is the most significant revision in nearly 20 years.

The new ceilings will result in higher monthly contributions for both employees and employers. However, they also come with increased social security benefits, as these benefits are directly tied to the new wage base.

This article summarizes — in the clearest way —

how much you will pay under the new rates

and what enhanced benefits employees will receive

Social Security Wage Ceiling & Contribution Ceiling (Effective 2026)

Old Ceiling (Before 2026)

- Maximum wage used for calculation: 15,000 THB/month

- Maximum contribution: 750 THB/month (Employee 5% + Employer 5%)

Even if employees earned 20,000 or 30,000 THB, contributions were capped at 750 THB.

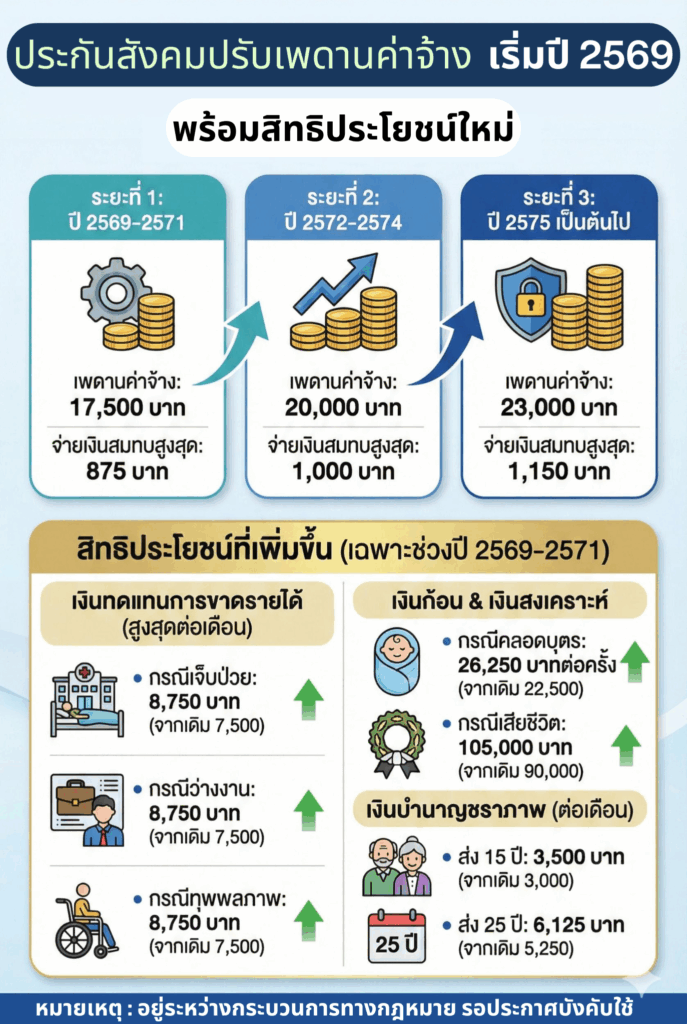

New 3-Phase Wage Ceiling Adjustment (Starting 2026)

Designed to reflect rising living costs and strengthen long-term welfare.

Phase 1 (2026–2028)

- Wage ceiling: 17,500 THB — Max contribution: 875 THB/month

Phase 2 (2029–2031)

- Wage ceiling: 20,000 THB — Max contribution: 1,000 THB/month

Phase 3 (2032 onward)

- Wage ceiling: 23,000 THB — Max contribution: 1,150 THB/month

How Much More Will You Pay?

- +125 THB in 2026

- +250 THB in 2029

- +400 THB in 2032

Benefits increase across all categories, making the change worthwhile.

Enhanced Social Security Benefits (Based on the 2026–2028 Wage Base)

When the wage ceiling increases, the benefit amounts increase accordingly:

Income Replacement Benefits

- Sickness benefit — 8,750 THB/month (from 7,500)

- Unemployment benefit — 8,750 THB/month (from 7,500)

- Disability benefit — 8,750 THB/month (from 7,500)

Maternity & Survivorship Benefits

- Maternity allowance — 26,250 THB (from 22,500)

- Death compensation — 105,000 THB (from 90,000)

Old-Age Pension

- 15 years of contributions — 3,500 THB/month (from 3,000)

- 25 years of contributions — 6,125 THB/month (from 5,250)

Summary:

Employees and employers pay slightly more, but receive significantly higher protection and long-term welfare benefits.

What Employers Need to Prepare (Most Important)

The ceiling change affects every organization. HR, Payroll, and Finance teams must prepare in advance.

1. Update the Payroll System to Support the New Ceiling

Check whether your current payroll system can:

- Apply the new wage ceiling

- Calculate 5% + 5% correctly

- Adjust automatically for all 3 phases

- Prevent over/under contributions

Organizations relying on Excel face a high risk of calculation errors.

2. Reassess Labor Budgeting

Employer contributions will rise for employees earning above the old ceiling.

Companies should forecast the impact on:

- Overall labor cost

- Cost per employee

- Department budgets

- Salary planning for the next fiscal year

3. Communicate Clearly with Employees

Some employees may worry when deductions increase. HR should explain that:

“A higher contribution = higher benefits and long-term protection.”

4. Update HR Manual / Employee Handbook

Revise documents such as:

- Employee Handbook

- Welfare Policies

- Payroll SOP

To ensure consistency across the organization.

5. Ensure Accurate and On-Time Contributions

The first year of change is prone to errors, such as:

- Wrong ceiling applied

- Wrong employer share

- Incorrect SSO submission amounts

- Missing updates across phases

Automated payroll systems help reduce these risks.

How COACH HCM Helps Organizations

The COACH HCM payroll system fully supports all 3 ceiling phases with enterprise-grade features:

- Automatic SSO ceiling updates every year

- Real-time contribution calculations (no manual formulas)

- Alerts when wages exceed the ceiling

- Automatic SSO Form 1-10 reports & submission files

- Error detection before submission (e.g., over/under deduction)

- Reduced HR workload and minimized legal risks

Ideal for organizations needing accuracy, compliance, and efficiency during this major policy transition.

Conclusion

The 2026 Social Security wage & contribution ceiling adjustment marks a major shift for Thailand’s labor welfare system. Although contributions will increase, the benefits—especially pensions, sickness benefits, maternity, and unemployment protection—will rise significantly.

Organizations that prepare early, especially by updating payroll systems and communication plans, will manage the transition smoothly and ensure employees receive their full entitlements.

Q&A: Social Security Wage & Contribution Ceiling Adjustment (2026)

Q1: What is the 2026 wage ceiling adjustment?

It is the increase in the maximum wage used to calculate contributions — from 15,000 THB to 17,500 → 20,000 → 23,000 THB, phased over multiple years, to reflect real living costs and improve Section 33 benefits.

Q2: How much more will employees and employers pay?

- 2026: 875 THB (+125)

- 2029: 1,000 THB (+125)

- 2032: 1,150 THB (+150)

Total maximum increase: 400 THB

Q3: Why is the ceiling being adjusted?

Because the old ceiling had been unchanged for almost 20 years and no longer matched current living costs. The adjustment ensures:

- Higher benefits

- Long-term sustainability of the Social Security Fund

- Better support for sickness, unemployment, maternity, disability, and pension

Q4: What benefits will increase?

- Sickness benefit: 8,750 THB/month

- Unemployment: 8,750 THB/month

- Disability: 8,750 THB/month

- Maternity: 26,250 THB

- Death compensation: 105,000 THB

- Pension: 3,500–6,125 THB/month depending on contribution history

Q5: How will high-income employees be affected?

They will pay more than before, but will also receive higher benefits, making the increase worthwhile for long-term protection.

Q6: How will employers be affected?

Employer contributions will rise proportionately, increasing labor costs—especially for organizations with many employees earning above the old ceiling.

Q7: Has the new ceiling been officially enforced?

Not yet. It is still under legal review and pending official publication in the Royal Gazette. However, implementation is expected to begin in 2026.