Severance Pay - Step by Step

Understanding severance pay under labor law is essential for both employers and employees. It directly affects compliance, taxation, and the risk of legal disputes if not handled correctly.

Types of Income Paid Upon Termination

These are the one-time payments an employer may provide when employment ends:

- Government Gratuity A severance payment made according to civil service pension regulations.

- Provident Fund (PVD) A voluntary savings fund jointly contributed by employer and employee, consisting of

- Employee’s Contribution – Fully returned to the employee upon resignation or retirement

- Employer’s Contribution – Returned based on the fund’s rules

- Investment Returns – Profits from fund investments, returned under the fund’s terms

- Severance Pay under Labor Law

A statutory payment required when an employee is dismissed without fault. Employers are not obligated to pay severance if the employee is terminated for cause, such as:

- Fraud or intentional damage

- Serious violation of company rules

- Absence without cause for over 3 consecutive working days

- Gross negligence

- Voluntary resignation

- Imprisonment (unless for a minor or unintentional offense)

- End of fixed-term employment contract

Severance Pay by Length of Service

The Thai Labor Protection Act defines the severance pay rate based on years of service:

Years of Service | Severance Pay (Final Wage) |

120 days – < 1 year | 30 days |

1 – < 3 years | 90 days |

3 – < 6 years | 180 days |

6 – < 10 years | 240 days |

10 – < 20 years | 300 days |

20+ years | 400 days |

Severance Pay Calculation Example

An employee has worked for 15 years and earns 50,000 THB/month.

- Entitlement = 300 days or 10 months

- Severance Pay = 50,000 × 10 = 500,000 THB

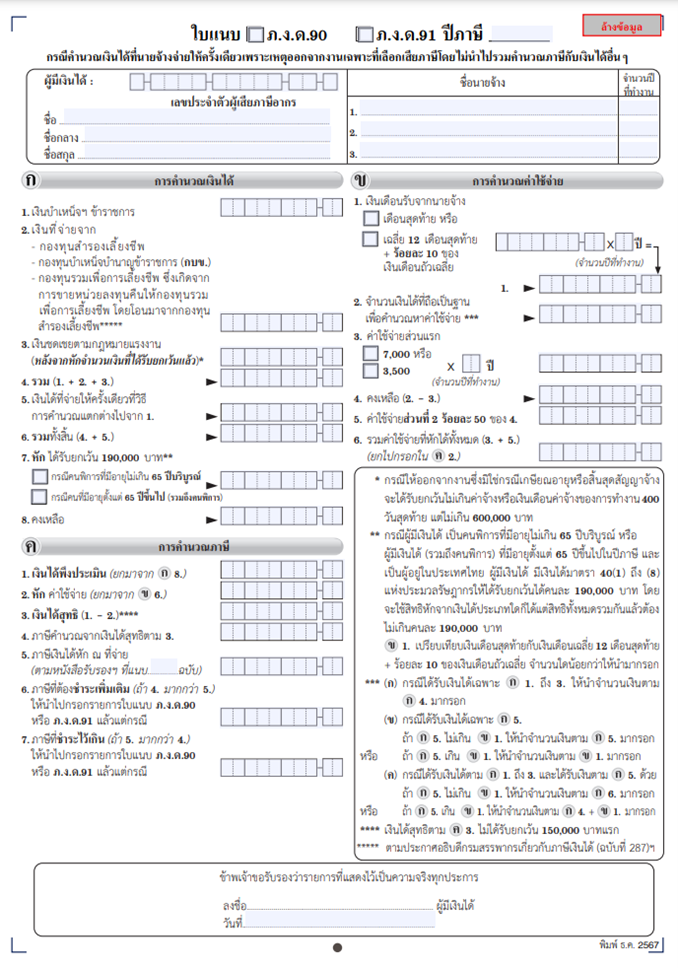

Tax Exemption on Severance Pay

Employees are eligible for a tax exemption on severance pay up to 400 days’ wages, not exceeding 600,000 THB, if not related to retirement.

Example:

- 50% × 50,000 × 15 years = 375,000 THB

- 400 days = (50,000 × 400) ÷ 30 = 666,667 THB

- Lesser amount = 375,000 THB (exempt)

- Taxable = 500,000 – 375,000 = 125,000 THB

Special Severance (One-Time Payment)

In some cases, employers provide additional lump-sum payments beyond legal severance. This is:

- Negotiated between employer and employee

- Taxed separately under Section 48(5) of the Revenue Code for reduced tax burden

Employees who’ve worked over 5 years and meet certain conditions may choose to calculate tax separately from other income.

What Employers Should Do

- Provide official termination notice

- Calculate and pay severance correctly and promptly

- Issue a work certificate for future employment or verification

What Employees Should Do

- Understand their severance rights under labor law

- Request documentation and payment evidence from the employer

- Contact the Department of Labor Protection and Welfare if rights are violated

Summary

Severance pay is a legal and financial obligation that must be handled properly. It protects employees’ rights and ensures fair offboarding. Understanding the rules around taxation and calculation helps minimize disputes and maintain healthy employer-employee relationships.

Looking for an HR software that simplifies severance pay and employee entitlement management?

COACH HCM offers complete tools for managing payroll, compliance, and personnel data — helping organizations stay accurate, fair, and efficient.